No-one likes paying taxes, but if we want to live in modern civilised societies, they’re a necessary evil.

At least they are to most members of society. Taxes are another way that we are divided.

Governments collect taxes through various mechanisms, but the main focus for us here is income tax. The tax applied to the salary we’re paid for doing our job.

Everyone is meant to pay income tax, but it’s collected in a couple of different ways.

For most people it’s collected at source. So your employer has a legal obligation to take the income tax you owe the government from your salary before paying you and passing that directly to the government on your behalf.

That’s a great system for governments as money comes straight to them for minimal effort. There’s no incentive for an employer to lie about what their employees earn, so the government can be pretty sure they’re receiving all the tax that is due to them.

Of course, this doesn’t work for people who aren’t employed by someone else.

These people have to tell the government how much they earned and pay them the tax that’s then due based on the figure they report.

For these people, there is very much an incentive to not tell the whole truth about how much they earned.

As long as they’re smart and report what sounds like a realistic figure, they can be a bit creative and reduce their income tax bill in a way that employed people can’t.

Obviously, the government can investigate people if they doubt the income they report is correct, but this can be time-consuming and expensive.

So if you’re employed, you have to accept that you’re always going to pay your tax in full, but the self-employed have a bit of flexibility.

In effect, there are two different tax systems in play.

How do you feel about the possibility that some people aren’t paying all the tax they should?

It’s Smart Not To Pay Tax

Are people who don’t pay income tax smart?

Some people seem to feel that way. I guess they think that if they don’t have the opportunity to cheat their tax, then they’re happy that at least someone else is giving the middle finger to the government.

I’m not sure that’s a good way to think about it.

While this opportunity isn’t exclusively available to the wealthiest in our societies, they tend to be the ones who can take maximum advantage. There’s actually a job that’s often titled as Wealth Consultant that’s largely focused on helping the wealthy retain as much of their wealth as possible.

Knowing that and human nature in general, my gut says the vast majority of the wealthy are being smart and doing all they can to avoid paying taxes of all descriptions.

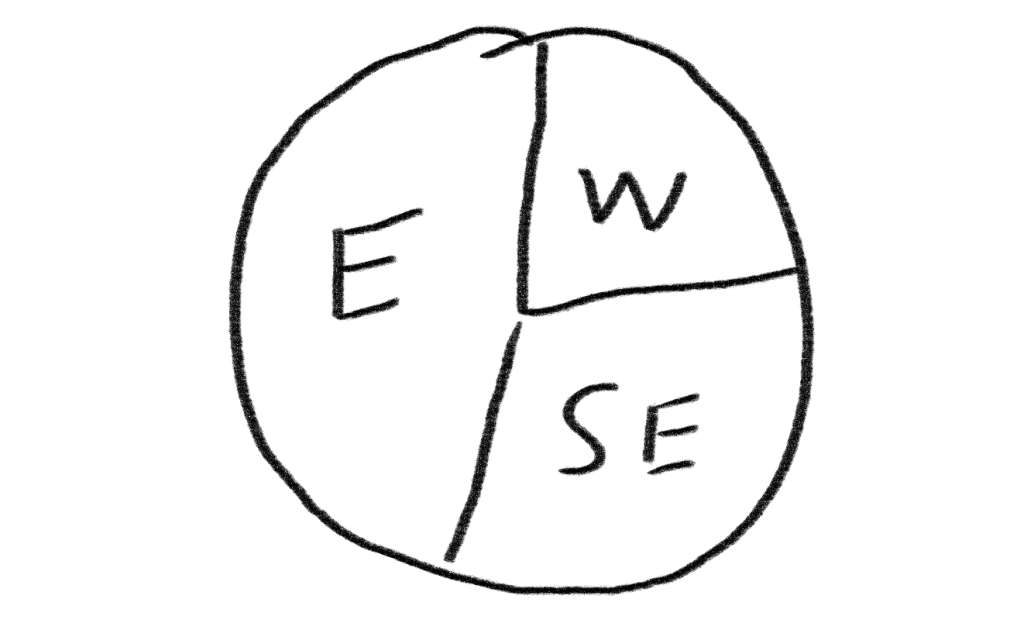

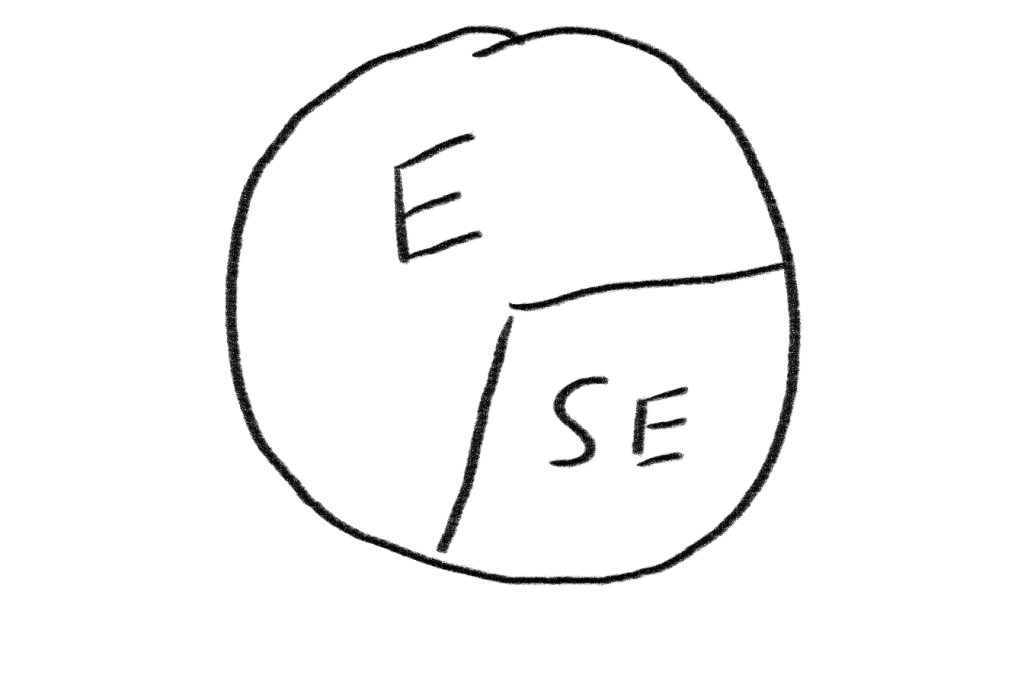

That pie chart is just meant to be illustrative of the income tax that different segments of society should pay. I’ve split it into employed (E), self-employed (SE) and super-wealthy self-employed (W). It may or may not represent realistic proportions, but that doesn’t matter as I want to illustrate something else.

If everyone on that chart pays the tax that they should pay, the government is happy.

What happens if that doesn’t happen though, if some people pay less tax than they should or even no tax?

Let’s suppose that everyone in the super-wealthy bracket pays zero income tax.

That may not be the case, but Donald Trump famously said he was smart for paying no federal income tax, so if he’s taking advantage of the way the system is set up, is it unreasonable to assume the rest of the super-wealthy are too?

The rest of the self-employed aren’t in the same position and so can only reduce the amount of tax they pay, rather than wiping it out altogether. Still, every little bit helps.

Now obviously the government isn’t going to be happy about this shortfall in tax as they’ve still got the same expenses to cover.

So if the super-wealthy and the self-employed aren’t paying their share, who’s going to make up the shortfall?

No sheep Sherlock!

Of course, the employed have to carry the can.

They’re the easiest to target because the employers are legally obliged to report how much they earn and take the tax before they’re paid.

So the richest in society enjoy the privilege of paying less tax than some of the poorest members and the rest of society has to cover the tax the richest aren’t paying.

But well done to the super-wealthy for sticking it to the man on our behalf. Aren’t they great?

A Little Bit of Balance?

Before moving on, any wealthy person reading this is probably spitting tacks right now.

So yes, in reality, the wealthy do pay a lot more tax than the poorest in society. According to the House of Commons Library, the top 10% of earners pay 60% of all the tax collected in the UK.1

And it also may be unfair to suggest that the wealthiest pay no tax at all.

ProRepublica looked into the top 400 wage earners in the US in a report they published in 2022. Their findings showed that none of the 400 individuals actually paid no tax.2

Aren’t I naughty for suggesting that?

The reality is that the lowest tax rate in that list, which applied to two individuals who earned $166 million and $127 million, was 0.7%. Not quite no tax, but not very much tax either. I bet you’d be a lot happier paying income tax at a rate of 0.7%.

In fairness, many of the individuals in that list are paying taxes at rates much higher than that, but it still illustrates the advantages they enjoy.

Back to the UK, using data from the Sunday Times Rich List and their Tax List, the former listing the richest people in the UK and the latter the biggest taxpayers, IPPR found just one of those in the top 10 richest people also appeared in the top 10 taxpayers.3

The London School of Economics published some research on the real tax rates of UK individuals who received £1 million in taxable income in the 2015-2016 tax year.4

A quarter of those paid tax at 45%, the upper tax rate at the time. So hats off to the 25% that appear to understand the obligation of individuals to society.

However, another quarter paid tax at less than 30%, while 10% of them paid just 11% tax. Taking into account the personal allowance, a person who earned £15,000 would also have been taxed overall at a rate of 11%.

Does that add some balance?

Personally, I’d be delighted to pay £2,374,934.38 income tax and National Insurance a year, because that would mean I had earned £5 million and I’d still have £2,625,065.62.5

Maybe I’m just a bit of a cheap date.

But They’ll Move Abroad If Taxes Are Too High

It’s a common refrain from politicians, and not just those on the right, that if taxes are too high, the successful wealthy business people that drive the economy will move to lower-tax countries.

I’d love to say it’s not true, but I’m going to share an example of someone doing exactly that.

However, I’m also going to argue that we should lean into it, partly because we’ll lose the ones that offer the least to our societies, and partly because I don’t believe we will lose as many as feared. We may also find that most will be no great loss and easily replaced.

Let me introduce you to Mr Benny Hedgehogs. Not his real name, but our alias for the subject of an interview with The Guardian newspaper – I’m not out to name and shame the wealthy just because I don’t agree with the way they behave.6

So Benny Hedgehogs is a successful businessperson who has built significant personal wealth from his business enterprises. His business, lets call it Benny Hedgehogs Little Loans, operates in several fields, including offering micro-loans in emerging markets. The business is making credit accessible to a huge number of people who might otherwise struggle to find ways to fund new ideas and businesses that could have a positive effect on many living in the societies of emerging nations. What he’s achieved appears to be impressive and could potentially be making a real difference to many living in poorer parts of the world.

With his family, he’s lived in London for many years, but as I write this, he’s in the process of moving out of the UK because he’s upset that a tax situation that many wealthy people like him have enjoyed for years is being changed.6 If he stays in London, he will have to pay more tax based on his international income, which he clearly believes is unreasonable. Instead, he thinks he should be able to name an amount of money that he is happy to pay for the right to continue living in the UK. In effect, while the rest of the population have all their tax rates set by the government, he believes that wealthy people like him should be able to set some of their own tax rates.

Assuming he’s not going to get that right, his intention is apparently to move to Monaco or Dubai, two tax-free nations.

If he wanted to live in Monaco or Dubai, he’d already be living there. With his wealth, he can choose to live where he likes. If you read the interview, you’ll see he actually praises the approach that Italy take with wealthy people like him, yet Italy isn’t on his list of countries he might move to. Why not? If they offer such an attractive deal, surely Italy would be the perfect destination for him and his family.

Some years ago, Mrs Forclift and I decided we liked the idea of living in the Canary Islands. I spent some time on the island of La Palma looking at potential new homes. I loved the island and enjoyed the visit, but we didn’t buy a property there in the end.

The Cumbre Vieja fracture across the island following the 1949 eruption and the possibility it could cause a collapse that would wipe out all the islands and flood parts of New York did concern me when I first heard about it, but it didn’t affect our decision.

The drive I took along the northern end of the island, passing through narrow hand-carved tunnels and driving 12km in second gear, farting the whole time as I stared down rocky cliffs to the Atlantic Ocean 100s of feet below didn’t affect the decision either. In fairness, I’m probably over-egging that description. I must have got into third gear at least twice driving back the same way later that day (though that may have been because I realised that the faster I drove, the sooner it would all be over).

No, what affected the decision was the fact that if the ground I was stood on wasn’t sloping upwards, it was sloping downwards. There was barely any flat space anywhere, at least at the northern end which we were looking at. There was one house I wanted to look at where the estate agent flat refused to come with me and told me where the front door key was hidden. My little hire car couldn’t make it up the first route Google suggested, the hill was so steep. We found another slightly less scary way and I got within about 200 metres of the house. From there it was clear that if we bought it, we’d have to take up base jumping every time we wanted to go out and learn how to abseil while carrying the shopping when we came home.

There were less extreme houses, but most of the island was absolutely knackering. We loved the idea of a climate that allowed outdoor living year-round, but once you’re outside, all you can do is stand still and try your best not to start rolling down a hill.

I mention this only because Hedgehogs was considering moving to Monaco. Monaco’s ducking hilly too. It’s also the most densely populated country in the world.

Dubai has got mountains, but it’s generally a bit flatter, and while the overall population density of the country is about a fifth of Monaco’s, in the main metropolitan area, it’s about 50% more densely populated again. Oh, and it’s ruled by an absolute monarchy, meaning the autocratic leader can do whatever they want to whoever they want whenever they want. If I had a huge wedge of money, I don’t think I’d want to go and live somewhere I had no democratic rights.

Monaco and Dubai may look glamorous on screen, but to me, and I’m really not trying to offend either location, they just look like self-imposed penal colonies for the mega-rich. Maybe that’s why Hedgehogs hadn’t chosen to live in either place before.

We have just one life on this planet and it’s a very short existence in the big scheme of things. Why anyone would prioritise digits on their bank statement over their and their family’s quality of life is beyond me. If someone’s lost their sense of what’s really important so badly, our societies are better off without them. Let’em go before they poison the water for everyone.

To me, and you and others may disagree, it looks like Hedgehogs is so wealthy, he believes he should be able to choose where he lives and also live by different rules to those applied to the rest of the people living in his chosen home. Wouldn’t you like to live where you choose and also set your tax rate?

Benny Hedgehogs wants to live in London, not Monaco or Dubai. That’s why he threw his little hissy fit in front of a journalist. He’s upset that he can’t have his cake and eat it.

I assume that’s why he also tells the interviewer he’s no longer going to list Benny Hedgehogs Little Loans on the London Stock Exchange in what would have been a claimed billion-dollar Initial Public Offering. Surely the reader is meant to feel that it’s a great loss to the UK. No doubt the London Stock Exchange will feel it, but should the average Brit be concerned by him taking Benny Hedgehogs Little Loans public in another country?

In the American Finance Association’s 2015 Presidential Address, the Italian academic Luigi Zingales7 stated “There is remarkably little evidence that the existence or the size of an equity market matters for growth.”8 The term equity market is just another phrase for a stock market, so in his opinion, Zingales doesn’t believe there’s evidence that a stock market powers economic growth. So, if Benny Hedgehogs Little Loans lists in London or elsewhere, there’s no quantifiable effect on the UK economy.

Also, as far as I can tell, Benny Hedgehogs Little Loans doesn’t operate in the UK and their nearest office is 1,500 miles away in Athens, Greece. If it did list in London, I’m sure some money would move into London to specifically buy their shares. However, do you think it’s also possible that money that would have been invested in businesses that operate in the UK might have been diverted to Benny Hedgehogs Little Loans, potentially reducing investment in UK businesses?

But am I being unfair to Hedgehogs? After all, he’s doing this for his children. He says in the Guardian interview that they need to move to protect the future wealth of his four children. He also says he’s close to being a billionaire. If he was worth just £760 million (closer to a billionaire than a half-a-billionaire), that would still be £190 million for each kid if he dropped dead today. If he’d married Mrs Feodor Vassilyeva9 in her prime, each one of their 69 kids would still have been in line for more than £11 million. How much protection does this wealth need?

The saddest thing in my eyes though, and again this is just my own opinion, you may disagree, is the example he’s setting for those kids. They’re being raised with the great privilege that immense wealth offers. The example their father is giving them is that when you’re wealthy, you should expect to be treated differently to others. The rules shouldn’t apply in the same way to the rich.

What a shame his example isn’t that the privilege of great wealth is the ability to make an outsize contribution to the society you live in and to make a difference beyond what others can. Particularly when that’s very much what his business Benny Hedgehogs Little Loans appears to be doing by making micro-loans accessible to so many people. Perhaps I’m too dumb to understand, but it appears to me that his professional values are in stark contrast to his personal values.

Oh well, whatever Mr Hedgehogs does and wherever he ends up, I genuinely hope he finds happiness from his choice. Obviously, Benny Hedgehogs Little Loans isn’t a charity, but the work it does through micro-loans could completely change the lives of countless people, who could go on to make huge and positive changes to their societies too.

Anyway, I said earlier I didn’t believe that many people would follow through and move just to avoid taxes. I believe that specifically because I think most people understand the importance of their quality of life. We live in the moment and if you can afford it, why wouldn’t you pay for you and those you love to live in the best possible moment?

Why try and nickel and dime your way through life when there’s only ever going to be one conclusion and even if there is an afterlife, your money isn’t going with you?

There are plenty of other places in the world beyond Monaco and Dubai that could be attractive to the wealthy, without looking like super plush open prisons. Yet many wealthy people choose to stay where they’re most comfortable. Paying less tax may be attractive, but being close to family and friends is very attractive too. Speaking the same language as those people around you and sharing many cultural values can also be difficult things to give up.

Societies probably won’t lose that many of the wealthy class for the simple reason that they can afford to stay. A small family hatchback will carry four people across a city just as quickly as a Rolls Royce, but the wealthy don’t buy the hatchback because they can afford the Roller.

Yes, our societies will lose some wealthy and influential people, but that should be more than offset by losing many more merely average people.

There’s a common truth in life that most of us are really quite average. In every role and every job there are a few exceptional people who stand out, but the majority blend into the same state of indifference.

One of the places we can see this so clearly is in the field of team sports, both professional and amateur. Whatever the sport, we will be able to find examples where the coach or manager of a team has been changed and the results start to change. They may completely tank or suddenly a team of losers look like world beaters, even though the players available to the new coach are exactly the same as before. More often than not though, we see teams remain at a fairly consistent level regardless of who’s in charge, indicating that most coaches are competent enough not to ruin a team, but lacking the ability to make any meaningful positive difference either.

We can see the same thing playing out across all fields.

You’re going to see me mention the Dunning-Kruger effect a few times and I’ll share a more in-depth explanation later. For now, just understand that those who are least competent at doing something are most likely to overestimate their ability to do that thing.

In any business, from the lowest level all the way up to senior management and the boardroom, you will find numerous individuals suffering from the Dunning-Kruger effect. It’s easy to assume that only the best rise to the top of any business, but the reality is that many get there through sucking up, ruthlessness and/or pure unadulterated luck.

Once they’re there, they insist that when business is going well, that’s entirely due to their brilliant leadership, but when business is going badly, then it’s entirely the fault of external factors far beyond their control.

And these are often the wealthy and powerful people appearing on TV and radio panel shows and news interviews insisting that taxes for the rich and businesses should be as low as possible and warning that society risks losing many great talents if this doesn’t happen.

Don’t listen to them. Don’t believe them.

If they’re not running their own business that they built up and they threaten to take their wealth with them somewhere else, hold the door open for them and wish them well.

Productive Wealth Vs Non-Productive Wealth

The way I see it, there are two types of wealth in this world. I’m going to name them productive wealth and non-productive wealth (actually I’ve just googled those terms in case I can save myself some thinking, but it looks like they’re not common terms).

They may not be great names, but this is what I mean.

Productive wealth is wealth that’s generated by entrepreneurs who are creating and growing businesses that create jobs and products/services that enhance and benefits society.

Non-productive wealth is wealth being generated from existing wealth that benefits just the owner of the original wealth without adding anything to society.

The wealthy are constantly banging on about how we mustn’t tax them too much because their wealth allows them to create more wealth for the societies they live in. We’ll look later at just what a load of bollards that claim generally is in Bolluchs Economics, but perhaps there may be cases when that makes sense, as well as cases when it absolutely doesn’t. First though, let’s consider a couple of examples of what I mean.

Both the UK and US are facing housing shortages that are making it harder and harder for the young and those on lower or even average wages to afford to buy their own homes. Is there really a housing shortage though, or is the problem a shortage of houses for sale?

Someone who builds a house and then sells that house for a profit is producing wealth for themself but has also produced a house that someone can buy and make their home. That reduces the housing shortage by one house.

However, someone who buys an existing house and then rents that house out to a tenant is only producing wealth for themself. It removes one house from the market and increases the shortage of available houses to buy by one.

In a society where there are people who want to buy houses, this is non-productive wealth as it only benefits the person with wealth and worse than that, it harms society as it removes a house from sale and forces someone who wants to buy to rent instead.

It actively harms the person forced to rent because it prevents them from being able to convert income into wealth. Instead of using their income to buy ownership of a house that will form part of their personal wealth as they pay off their mortgage, the person is forced to spend their income on a one-off transaction that turns their money into wealth for the property owner.

The person who had the wealth to buy the property gains even more wealth at the expense of those with little or no wealth.

Let me sidetrack briefly, the claim that there’s a shortage of housing in the UK doesn’t necessarily match the facts. The number of surplus dwellings in comparison to households has actually been growing this century.10 Yet at the same time, the average price of those dwellings has increased by 181%.

Now I’m not an economist so I’m sure I’m making some naive schoolchild mistake here, but I could have sworn capitalism tells us that prices are set by the relativity of supply and demand. When demand is greater than supply, prices rise and conversely, if supply is greater than demand, prices fall.

So how come, if supply has increased, prices have also increased?

Before World War One, private rentals in the UK accounted for 90% of dwellings, but that had fallen to 58% by 1938 in response to laws that reduced the powers of landlords and gave renters greater rights.11 By 1988, a combination of legislation and high interest rates had reduced the number of private rentals in the UK to less than 8% of dwellings.12

When there are less landlords buying up housing stock to generate wealth for themselves, the availability of more houses makes them more affordable for everyone.

By 2023, the number of private rentals had increased by almost 2.5 times to 18.8%13, meaning greater competition to buy houses and higher prices making houses unaffordable to many buyers.

We can probably assume that the “housing shortage” in the US is driven by similar factors as the number of dwellings in the US in relation to the population is higher in 2024 than it has been at any time this century.14

Sorry, let’s get back on track. A second example of productive wealth is a company that makes electric bikes and is creating wealth for its owners while also creating employment and producing transport that will help members of society get around and stay fit.

A person that makes wealth by short-selling shares in the electric bike company is creating wealth for that person only. Society doesn’t enjoy any benefit of members gaining employment, nothing is produced and at worst the short-selling could even harm the electric bike company.

Non-productive wealth is about using existing wealth to hoover up as much more wealth as possible without contributing anything to society in return (actually, they’re hoovering up income from poorer members of society and converting it into wealth for themselves). It’s achieved at the expense of those in society who are creating products and services that society relies on.

Why shouldn’t that kind of wealth be taxed at a very high rate? The wealthy will still be acquiring more wealth, but not as quickly. They may be upset by such a turn of events, but do you think they have too much to complain about?

How would you feel if I gave you 50 million spondoolix? Whether it’s pounds or dollars, it’s a huge amount of money. There’s a catch though, you can never work again. Would you accept or would you worry about your ability to live your whole life with just that amount of money? To help you make this difficult decision, if you received the money aged 18 and lived to 100, you’d have 609,756 spondoolix per year. The average American earns $1.7 million over their lifetime15, while the average Briton does rather worse at £566,000.16

In that context, doesn’t 50 million spondoolix look great? Realistically you could live a fantastic life doing what you wanted.

Let’s make up someone who has inherited half a billion spondoolix. They’ve not earned this money, just received it as the result of a fluke of nature and their genes. If they were taxed at 90%, they would still have 50 million spondoolix. Sure, they’d probably feel a bit hard done by, no more private jet instead having to fly commercial in first class with a fold-down bed, but wouldn’t you swap places with them in a heartbeat?

If non-productive wealth is made less attractive, then perhaps some of the wealthiest will turn to trying to generate productive wealth that comes with benefits for all members of society.

I’m starting to feel sorry for Benny Hedgehogs as I’m coming back to him again.17 However, his business operates in other markets, so while he chose to live in the UK for many years, to the UK economy he was effectively a creator of non-productive wealth.

So, you know what this calls for?

That’s right, spot on, The Ramones cover of Bye Bye Baby.18

- https://commonslibrary.parliament.uk/research-briefings/cbp-8513/#:~:text=Individual%20taxpayers%3A%20income%20tax%20paid,60%25%20of%20income%20tax%20receipts. ↩︎

- https://projects.propublica.org/americas-highest-incomes-and-taxes-revealed ↩︎

- https://www.ippr.org/media-office/missing-the-uk-s-richest-who-are-absent-from-the-sunday-times-top-10-taxpayers-list ↩︎

- https://www.lse.ac.uk/research/research-for-the-world/economics/how-much-tax-do-the-rich-really-pay ↩︎

- https://www.which.co.uk/money/tax/income-tax/tax-rates-and-allowances/income-tax-calculator-aNIhq2U0bUxs for 2022-23 ↩︎

- The Guardian names him though, so you know I’m not making him up – https://www.theguardian.com/news/2024/may/02/i-am-moving-tycoon-bassim-haidar-non-dom-tax-status-super-rich-exodus ↩︎

- https://en.wikipedia.org/wiki/Luigi_Zingales ↩︎

- https://www.nber.org/system/files/working_papers/w20894/w20894.pdf ↩︎

- https://www.guinnessworldrecords.com/world-records/most-prolific-mother-ever ↩︎

- https://www.sciencedirect.com/science/article/pii/S0921800922002245#f0005 ↩︎

- https://en.wikipedia.org/wiki/Housing_in_the_United_Kingdom ↩︎

- https://en.wikipedia.org/wiki/Housing_Act_1988 ↩︎

- https://www.uswitch.com/mortgages/buy-to-let-statistics/private-rental-statistics ↩︎

- https://fred.stlouisfed.org/graph/?g=Mc22 ↩︎

- https://www.zippia.com/answers/how-much-does-the-average-person-make-in-a-lifetime/ ↩︎

- https://www.quotezone.co.uk/home-insurance/guides/average-lifetime-arnings-uk ↩︎

- Of course, I’m kidding, Benny Hedgehogs chose to throw his toys out of his pram in front of a journalist because the British people were being really mean and nasty to him and he wanted them to know he’s a big loss to the UK population, so let’s get as much value out of that interview as possible ↩︎

- https://www.youtube.com/watch?v=Ubh-XwkA1zQ, of course, Jimmie Krankie would probably have chosen this version (who? don’t worry, you’ll meet him a little later) https://www.youtube.com/watch?v=zVxAj-Mis6o ↩︎